luckyaces168 Indonesian central bank announces surprise rate cut

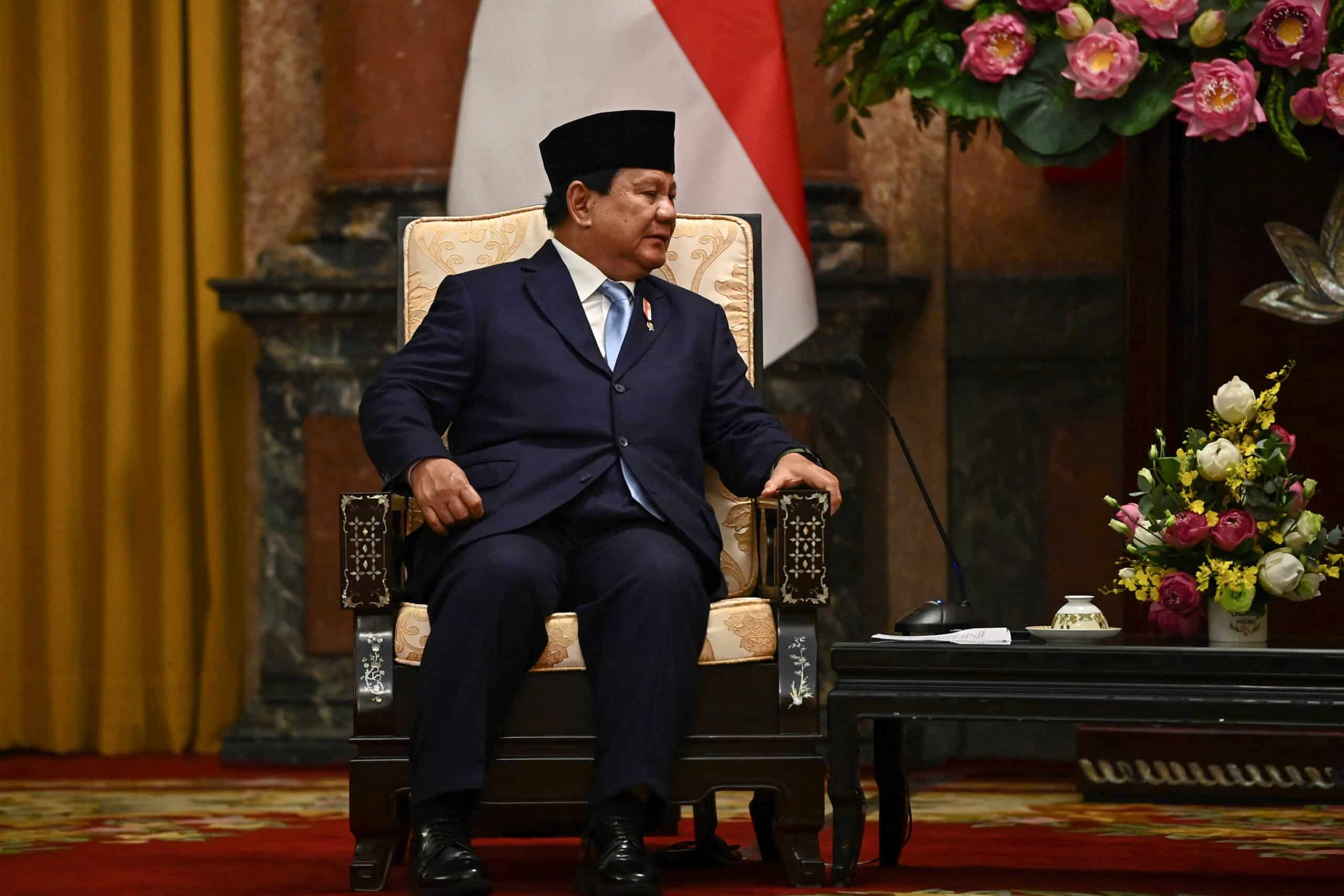

Indonesia’s Defence Minister and president-elect Prabowo Subianto attends a meeting with Vietnam’s President To Lam (not pictured) at the Presidential Palace in Hanoi on September 13, 2024. (Photo by Nhac NGUYEN / AFP)

Jakarta, Indonesia — Indonesia’s central bank on Wednesday unexpectedly cut key interest rates for the first time in more than three years as the rupiah strengthens and ahead of an expected US reduction later in the day.

Bank Indonesia lowered the seven-day reverse repurchase rate by 25 basis points to six percent, marking the first such move since early 2021. Its two other main rates were also cut by 25 basis points.

Article continues after this advertisement“The Federal Funds Rate direction is getting clearer, and the rupiah is relatively stable and even getting stronger,” bank governor Perry Warjiyo told reporters.

FEATURED STORIES BUSINESS National ID gives more Filipinos ‘face value BUSINESS BIZ BUZZ: Unwinding Gogoro … quietly BUSINESS Polvoron maker seeks P500 million capital for expansion“These two factors are the reason why we lowered the interest rate right now.”

READ: Indonesia posted FDI worth $47B in 2023 – investment ministry

Article continues after this advertisementThe central bank had steadily increased borrowing costs to defend the rupiah amid growing global economic uncertainty and rising inflation.

Article continues after this advertisementBut with price rises slowing, Perry said the decision to cut was consistent with the bank’s prediction that inflation would remain low in 2024 and 2025.

Article continues after this advertisement“With inflation under control and the rupiah rebounding against the US dollar, further cuts are likely,” said Gareth Leather, senior Asia economist at Capital Economics.

A World Bank report said in June that Southeast Asia’s biggest economy is expected to steadily grow over the next two years on the back of domestic consumption and investment despite weak exports.

Article continues after this advertisementA new government under Prabowo Subianto will take office next month and its 2025 budget is expected to outline an implementation plan for the new administration’s economic goals, and signal its fiscal policy stance.

Subscribe to our daily newsletter